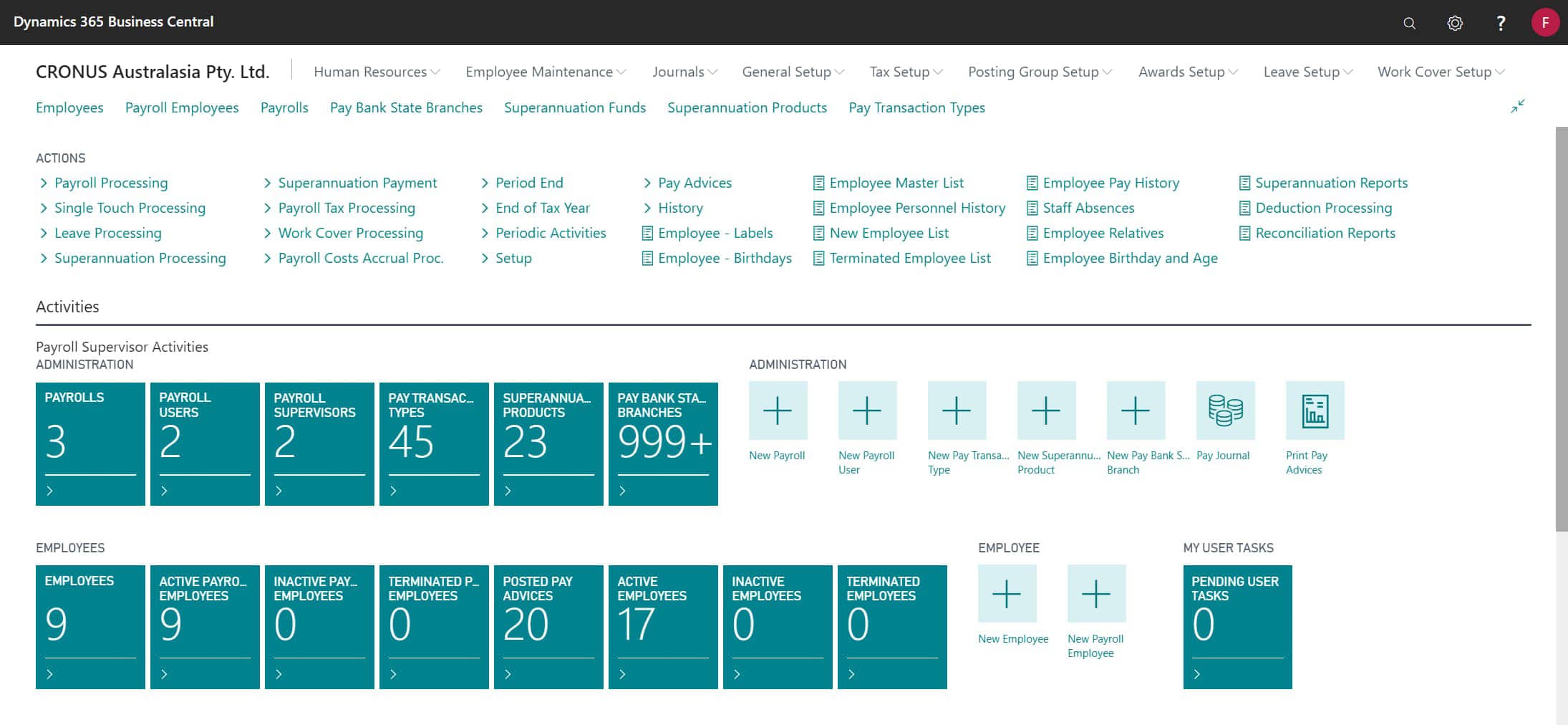

Implement Dialog Payfocus Payroll to manage and calculate wages for employees.

It’s fully linked to your financials, great for companies seeking a more integrated payroll system. It handles all aspects from time and attendance, payroll processing and roster integration.

Supports all processing needs

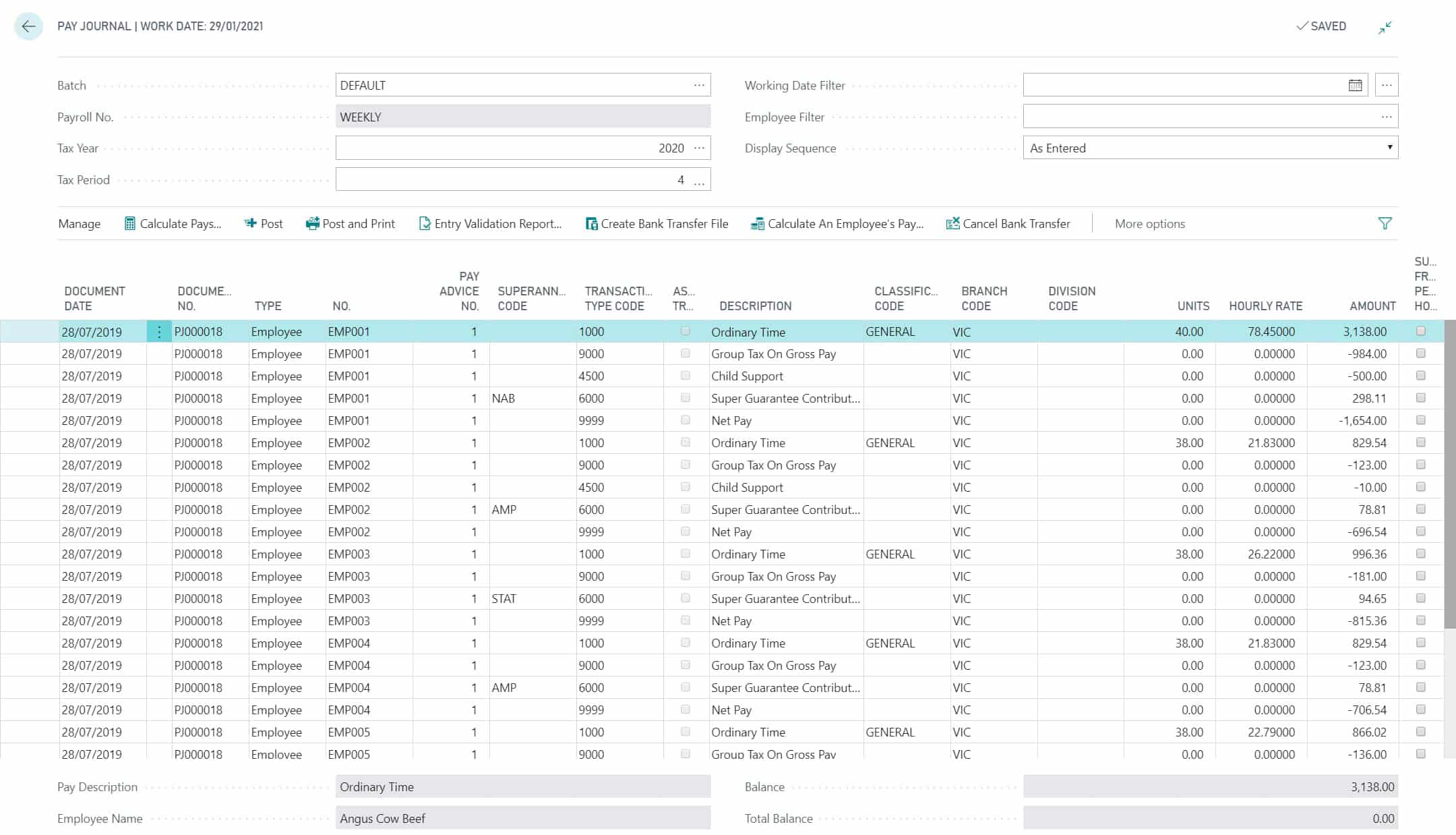

From job costing & payrun processing, to leave and tax calculations, and easily integrates with time and attendance providers.

Complies with requirements

Meets all legislative requirements, such as SuperStream and Single Touch Payroll (STP). Compliant with all Australian bank formats such as Commonwealth Bank, Westpac, NAB and ANZ.

Single Touch Integration

Payfocus includes single touch integration which allows the instant reporting of tax and super employee information to the Australian Tax Office (ATO) on each pay run. This streamlines the process without companies needing to change their pay-cycle.

Reduce payroll errors

Control reports highlight any potential mistakes, enabling correction before the pay run process is completed.

Adaptable

Suit unique business processes with system flexibility.

Secure

Fool proof security options and controls that govern user access, and controls on viewing and editing records.

Implementation with Fenwick

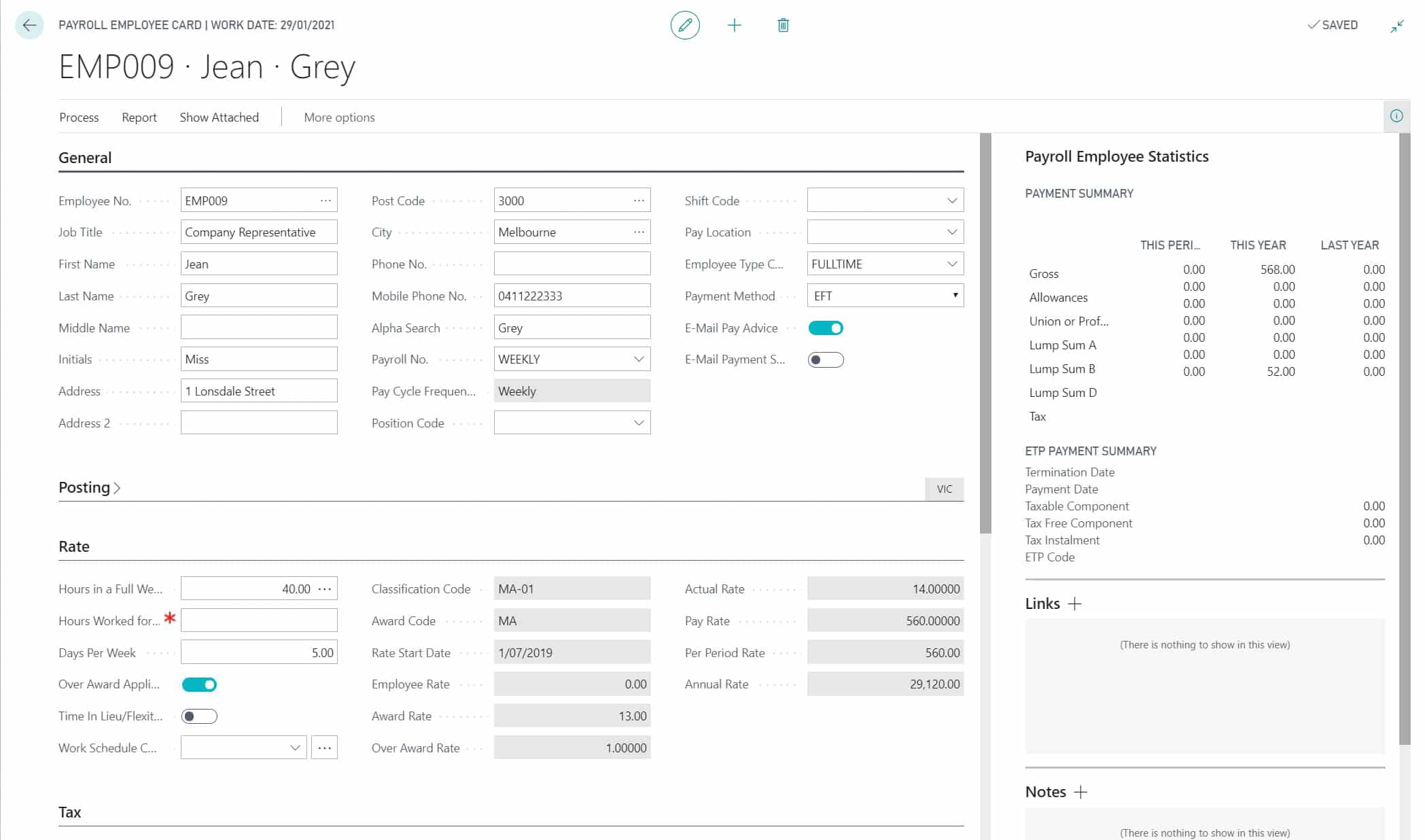

We’ve streamlined the payroll implementation process around an employee master data template.

The template is designed in an Excel format, so it’s easy to capture data for migration. Once imported, it’s validated and checked for data integrity.

We’ve streamlined the Leave Processing process and added more traceability to the General Ledger to aid in reconciliation.

- Data templates dramatically reduce migration time and effort

- BSB and account number validation

- Import of opening leave entitlement balances for take on

- Simplified leave processing with detailed links to the General Ledger for easier reconciliation

- Management of payroll tax codes against the pay element