Follow the process below to generate BAS figures and post the GST settlement.

Creating a new BAS Report

- Locate and open the BAS Report List

- Create a New BAS Report

- Use the Suggest Lines function to populate the BAS Report and set the Start Date and End Date

- Complete the request page based on the options below

- Press OK

| Option | Description |

|---|---|

| Include GST Entries | Select Open, so that only GST Entries that have not been on a previous BAS are included. |

| Include GST Entries | Select Before and Within Period so that any GST Entries that were accidentally posted back into a closed period are also included. |

| GST Statement Template | Select BAS. |

| GST Statement Name | Select the template that was setup for your company. |

| Period Year, Period Type, Period No. | Select the options for the relevant BAS period. |

| Amounts in Add. Reporting Currency | Note that if the BAS Report should be in Additional Reporting Currency, use the Show More button to reveal this option. |

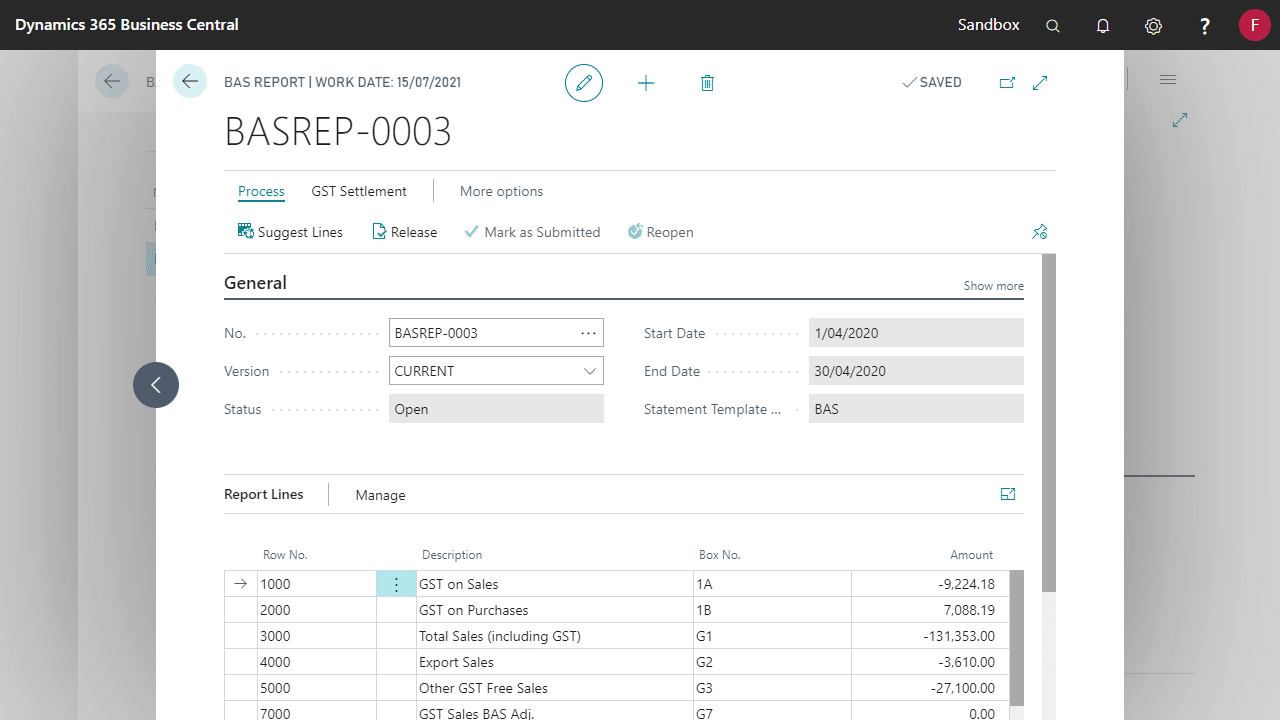

The BAS Report will be updated with the data, based on the GST Statement setup.

The Amounts in Add. Rep. Currency and Include Open Entries before Start Date fields on the BAS Report will be updated to reflect the selections that were made when Suggest Lines was run. They cannot be manually changed.

Release & Submit

Review the data and balance the amounts to the relevant G/L Accounts. If all is balanced, then select Release to change the Status of the BAS Report. At this point, the BAS Report can still be re-opened, and Suggest Lines rerun.

When the amounts are finalised and correct, select Mark as Submitted. No changes are allowed once the Status is Submitted.

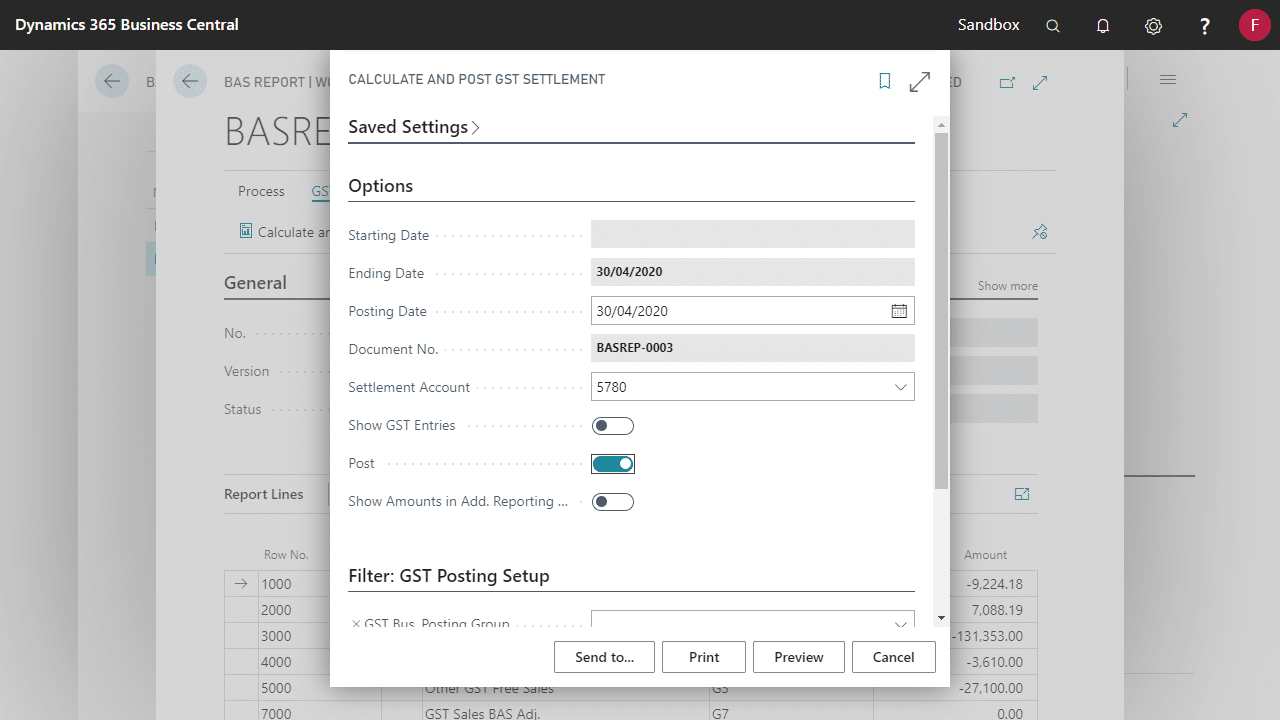

Calculate and Post GST Settlement in Business Central

From the BAS Report page, choose Calculate and Post GST Settlement.

This routine creates General Ledger Entries which clear the GST Collected and GST Paid accounts for the period, using the figures calculated for boxes 1A and 1B.

This process will mark the GST Entries as Closed.

| Report Option | Effect |

|---|---|

| Starting Date | Will be filled in based on the selections that were made when Suggest Lines was run. If Before and Within Period had been selected when Suggest Lines was run, Starting Date will be blank. |

| Ending Date | |

| Posting Date | The posting date for the settlement journal. |

| Settlement Account | The GL Account where the GST Paid and GST Collected will be posted to. |

| Post | Whether to generate and post the settlement journals. Untick to run the report and check totals before posting. |

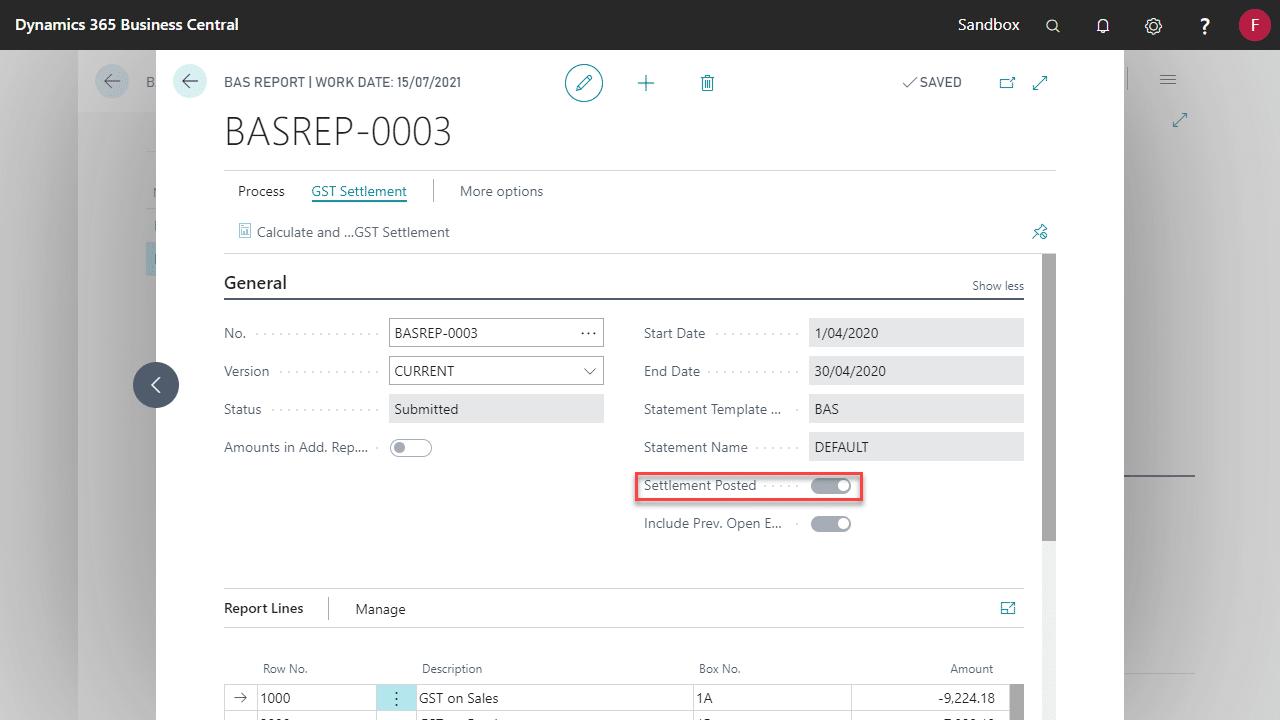

Checking if a BAS Report was posted

Settlement Posted flag on the BAS Report will be set if it’s been posted.

Analysis of your BAS in Business Central

The following reports/pages allow reconciliation and analysis of the GST transactions:

- GST Sales Entries – Accessible from the BAS Report under Actions. Detail of all GST Entries for Customers. GST Report to be setup on General ledger Setup.

- GST Purchase Entries – Accessible from the BAS Report under Actions. Detail of all GST Entries for Vendors. GST Report to be setup on General ledger Setup.

- G/L – GST Reconciliation – Verifies that the GST amounts on the GST statements match the amounts from the G/L entries

- GST Report – Customer – A printed version of GST Sales Entries.

- GST Report – Vendor – A printed version of GST Purchase Entries.